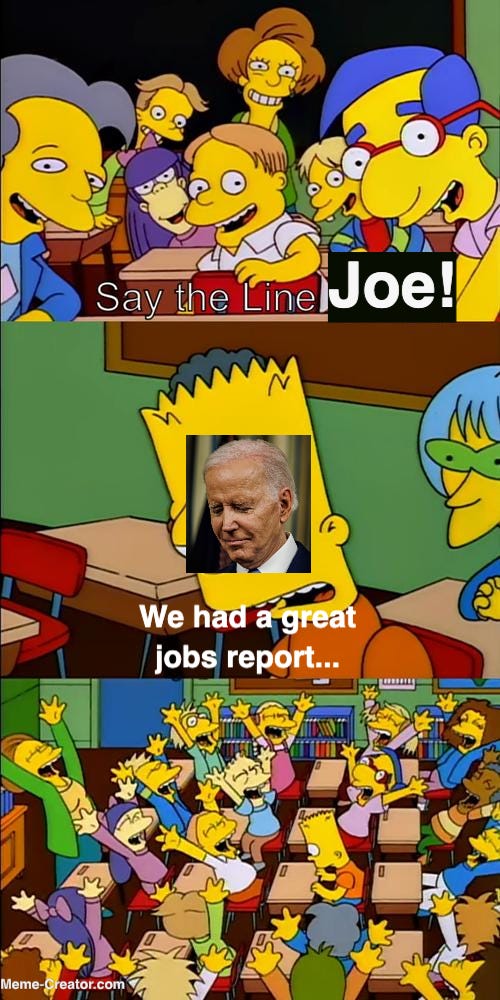

May 5: “Say the line, Joe!”

In which, more banks collapse but President Biden still talks about jobs numbers, Sudan succumbs to civil war, and Iran flexes its regional muscle.

“Say the line, Joe!”

You’ve got inflation you need to fight, so you raise interest rates to cool things down only for the rate changes to ring alarm bells over the stability of the banking system, which triggers runs that see multiple banks fail.

That’s been the story of 2023 in the world of American macroeconomic policy. This week saw yet another round of bank collapse alongside an interest rate hike. The rate hike pressure, though, is ramping up on regional banks in the US as First Republic became the latest victim to the financial instability roiling American markets. With at least one more round of rate hikes in the offing, this roller coaster isn’t done yet.

Several countries in the Middle East also raised their interest rates in response to the Fed’s most recent hike, which plummeted their own stock exchanges indicating the global effect that America's macroeconomic moves can have.

Closer to home, tightening financial markets coupled with increasing AI capabilities are making large employers like IBM reconsider how many employees they really need to be paying.

By this time, if you’ve been watching closely, you know it’s about time for the Biden administration to make a big deal of about jobs:

Yes. Yes, we did get a “good” jobs report for April, and that is certainly nothing to sneeze at. However, job growth only translates into economic growth if employees turn their paychecks right around into purchases. If they elect to save or pay down debt, demand (and GDP by extension) won’t expand, and we’ll still get a recession.

Keep reading with a 7-day free trial

Subscribe to Tim Talks Politics to keep reading this post and get 7 days of free access to the full post archives.